One Difficulty With Self-imposed Budgets Is That They Are Not Subject to Any Type of Review

Budgeting

39 Describe How and Why Managers Use Budgets

Implementation of a visitor's strategic plan oft begins by determining management's basic expectations nearly future economic, competitive, and technological conditions, and their effects on anticipated goals, both long-term and short-term. Many firms at this stage conduct a situational analysis that involves examining their strengths and weaknesses and the external opportunities bachelor and the threats that they might face up from competitors. This mutual analysis is frequently labeled as SWOT.

After performing the situational assay, the organization identifies potential strategies that could enable achievement of its goals. Finally, the visitor will create, initiate, and monitor both long-term and curt-term plans.

An of import footstep in the initiation of the visitor's strategic program is the cosmos of a budget. A good budgeting system will help a visitor attain its strategic goals by allowing management to program and to control major categories of activeness, such every bit revenue, expenses, and financing options. As detailed in Accounting as a Tool for Managers, planning involves developing time to come objectives, whereas decision-making involves monitoring the planning objectives that have been put into place.

There are many advantages to budgeting, including:

- Communication

- Budgeting is a formal method to communicate a visitor'due south plans to its internal stakeholders, such as executives, section managers, and others who have an interest in—or responsibility for—monitoring the company's performance.

- Budgeting requires managers to plan for both revenues and expenses.

- Planning

- Preparing a budget requires managers to consider and evaluate

- The assumptions used to set up the budget.

- Long-term financial goals.

- Short-term financial goals.

- The company's position in the market.

- How each department supports the strategic plan.

- Preparing a budget requires departments to work together to

- Make up one's mind realizable sales goals.

- Compute the manufacturing or other requirements necessary to see the sales goals.

- Solve bottlenecks that are predicted by the budget.

- Classify resources then they tin be used effectively to come across the sales and manufacturing goals.

- Compare forecasted or flexible budgets with actual results.

- Preparing a budget requires managers to consider and evaluate

- Evaluation

- When compared to bodily results, budgets are early on alerts and they forecast:

- Cash flows for various levels of product.

- When loans may be required or when loans may be reduced.

- Budgets prove which areas, departments, units, and so forth, are profitable or meet their appropriate goals. Similarly, they as well show which components are unprofitable or do not attain their anticipated goals.

- Budgets set defined benchmarks that may be used for evaluating company and management functioning, including raises and bonuses, likewise as negative consequences, such as firing.

- When compared to bodily results, budgets are early on alerts and they forecast:

To sympathize the benefits of budgeting, consider Big Bad Bikes, a company that manufactures high-end mountain bikes. The company will begin producing and selling trainers this twelvemonth. Trainers are stands that allow a rider to ride their bike indoors similar to the manner bikes are used in spinning classes. Big Bad Bikes has a v-year plan and has always been successful in managing its budget. Managers participate in developing the upkeep and are aware that all expenses must be related to the company'due south strategic plan. They know that managing their departments is much easier when the budget is developed to support the strategic plan.

The programme for Big Bad Bikes is to introduce itself to the trainer market place with a sales price of $70 for the showtime two quarters of the year and then heighten the price to $75 per unit. The marketing section estimates that sales volition exist 1,000 units for the beginning 2 quarters, ane,500 for the tertiary quarter, and ii,500 per quarter through the second year. Management will work with each section to communicate goals and build a budget based on the sales plan. The resulting upkeep can be evaluated by all departments involved.

Break-Even Analysis and Profitability

In the long run, proper budget reporting assists management in making proficient decisions. Management uses budgets to evaluate the performance of employees and their department. They tin can also utilize budgets to evaluate and criterion the performance of a business organization unit in a large business organisation organization or of the entire performance of a small company. They can also use budgets to evaluate separate projects. In budgeting situations, employees may feel a tension between reporting actual results and reporting results that reach the predetermined goals created by the budget. This creates a situation where managers may choose to act unethically and pressure accountants to study favorable fiscal results not supported past the operations.

Accountants need to be aware of this circumstance and use ethical standards when assisting the development and cosmos of budgets. After a proper budget has been created, the reporting of the actual results volition assist in creating a realistic and honest picture of the actual operations for the managers reviewing the budget. The budget accountant needs to take steps to ensure that employees are not trying to misreport the budget results; for instance, managers might exist tempted to set artificially depression standards to ensure that targets are hit and significantly exceeded. Such results could lead to what might be considered as excessive bonuses paid to managers.

The Basics of Budgeting

All companies—big and small—have limits on the corporeality of money or resource they can receive and pay out. How these resources are used to reach their goals and objectives must be planned. The quantitative plan estimating when and how much cash or other resources volition exist received and when and how the greenbacks or other resource will exist used is the budget. Every bit you lot've learned, some of the benefits of budgeting include improved communication, planning, coordination, and evaluation.

All budgets are quantitative plans for the future and will be constructed based on the needs of the organisation for which the budget is being created. Depending on the complication, some budgets can take months or even years to develop. The nigh common time period covered past a budget is i year, although the time period may vary from strategic, long-term budgets to very detailed, short-term budgets. Generally, the closer the company is to the start of the budget's fourth dimension period, the more than detailed the budget becomes.

Management begins with a vision of the hereafter. The long-term vision sets the direction of the company. The vision develops into goals and strategies that are built into the upkeep and are direct or indirectly reflected on the primary budget.

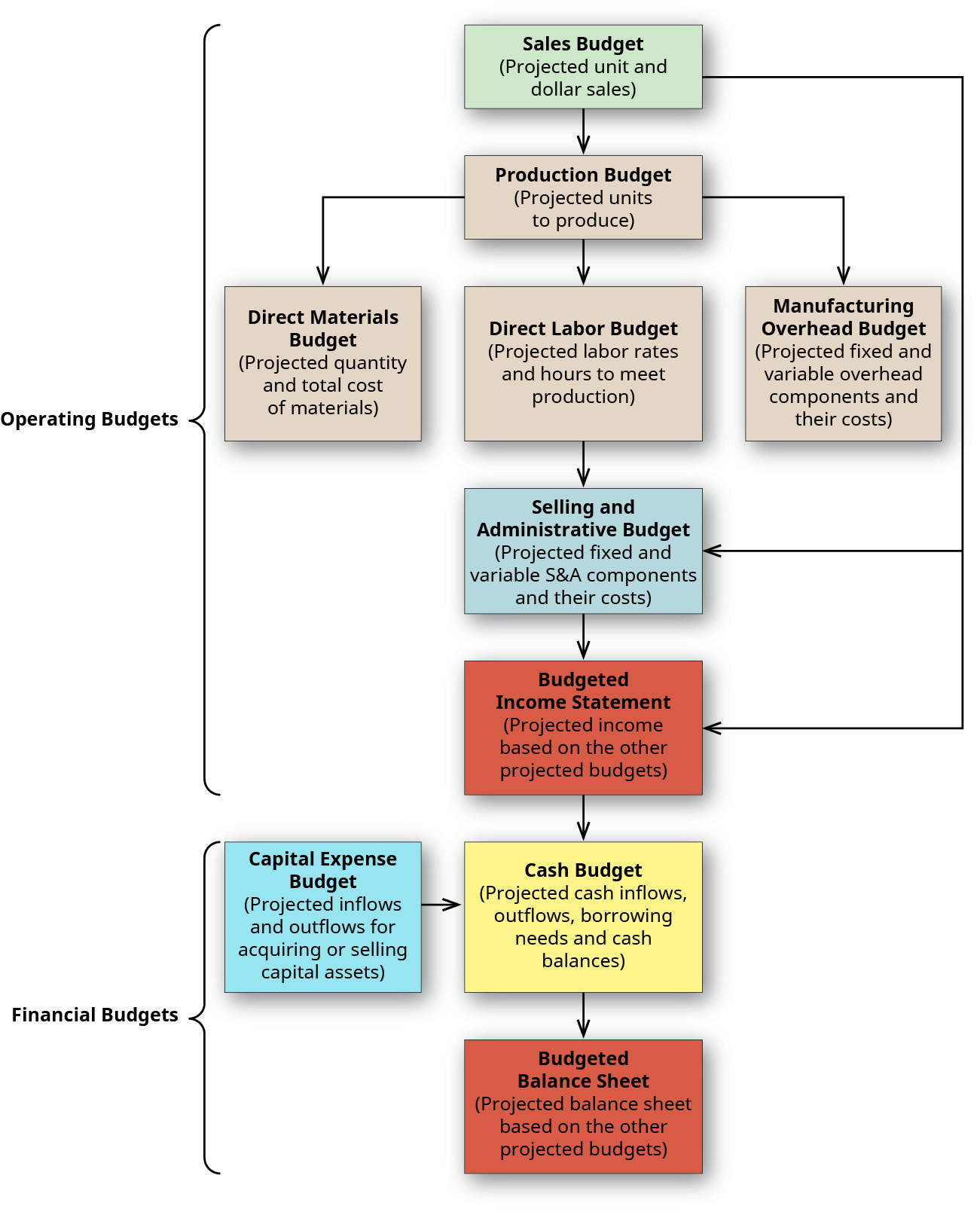

The master upkeep has two major categories: the financial budget and the operating budget. The financial budget plans the use of assets and liabilities and results in a projected balance sheet. The operating budget helps plan future revenue and expenses and results in a projected income statement. The operating budget has several subsidiary budgets that all begin with projected sales. For example, direction estimates sales for the upcoming few years. Information technology then breaks downwards estimated sales into quarters, months, and weeks and prepares the sales budget. The sales budget is the foundation for other operating budgets. Management uses the number of units from the sales upkeep and the company's inventory policy to determine how many units demand to be produced. This information in units and in dollars becomes the production budget.

The production budget is then broken up into budgets for materials, labor, and overhead, which utilize the standard quantity and standard price for raw materials that need to be purchased, the standard direct labor rate and the standard direct labor hours that need to be scheduled, and the standard costs for all other directly and indirect operating expenses. Companies use the historic quantities of the amount of fabric per unit and the hours of direct labor per unit to compute a standard used to gauge the quantity of materials and labor hours needed for the expected level of production. Current costs are used to develop standard costs for the price of materials, the direct labor rate, as well equally an gauge of overhead costs.

The upkeep development process results in various budgets for various purposes, such as revenue, expenses, or units produced, but they all brainstorm with a programme. To save time and eliminate unnecessary repetition, direction frequently starts with the current year's budget and adjusts it to meet futurity needs.

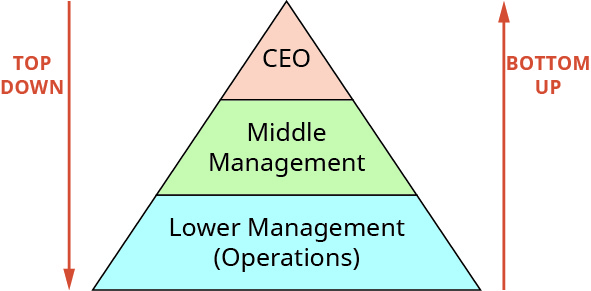

There are various strategies companies use in adjusting the budget amounts and planning for the future. For case, budgets can be derived from a top-downwardly arroyo or from a lesser-upwards approach. (Effigy) shows the general difference betwixt the summit-down approach and the lesser-upwards approach. The height-down approach typically begins with senior direction. The goals, assumptions, and predicted revenue and expenses information are passed from the senior managing director to middle managers, who further pass the data downward. Each department must then determine how it tin can classify its expenses efficiently while still coming together the company goals. The do good of this arroyo is that information technology ties in to the strategic plan and company goals. Some other benefit of passing the corporeality of allowed expenses downward is that the last predictable costs are reduced by the vetting (fact checking and information gathering) process.

In the acme-down approach, management must devote attending to efficiently allocating resources to ensure that expenses are not padded to create budgetary slack. The drawback to this approach to budgeting is that the budget is prepared by individuals who are not familiar with specific operations and expenses to understand each department'southward nuances.

Acme-Down versus Bottom-Up Approach to Budgeting. The top-down approach to budgeting starts with upper-level management, while the bottom-up approach starts with input from lower-level management. (attribution: Copyright Rice University, OpenStax, under CC By-NC-SA iv.0 license)

The bottom-up approach (sometimes also named a self-imposed or participative upkeep) begins at the lowest level of the visitor. After senior management has communicated the expected departmental goals, the departments and then plans and predicts their sales and estimates the amount of resources needed to attain these goals. This information is communicated to the supervisor, who then passes information technology on to upper levels of management. The advantages of this approach are that managers feel their piece of work is valued and that knowledgeable individuals develop the budget with realistic numbers. Therefore, the budget is more likely to be attainable. The drawback is that managers may not fully understand or may misunderstand the strategic programme.

Other approaches in addition to the top-down and bottom-up approaches are a combination approach and the zero-based budgeting approach. In the combination arroyo, guidelines and targets are set at the top while the managers work to develop a budget within the targeted parameters.

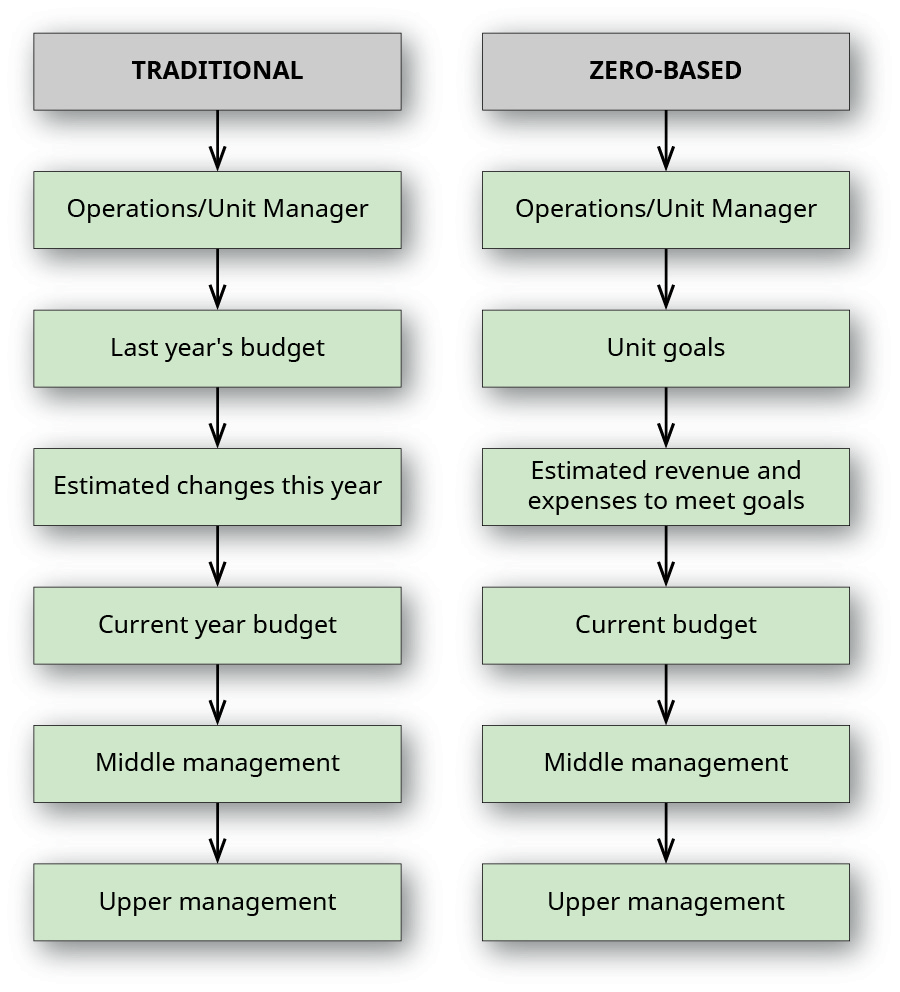

Zero-based budgeting begins with zero dollars and so adds to the budget only revenues and expenses that can exist supported or justified. (Figure) illustrates the difference betwixt traditional budget preparation and zero-based budgeting in a lesser-upward budgeting scenario. The advantage to null-based budgeting is that unnecessary expenses are eliminated because managers cannot justify them. The drawback is that every expense needs to exist justified, including obvious ones, so it takes a lot of time to complete. A compromise tactic is to use a zero-based budgeting approach for sure expenses, like travel, that tin can be easily justified and linked to the visitor goals.

Comparison of Traditional Budgeting Procedure and Null-Based Budgeting Process. In a bottom-up budgeting surround, the budget process begins with lower level or operational management. Nether a traditional budgeting, last yr's budget would exist the starting betoken for creating the current budget. Under a aught-based budgeting arroyo, all budget numbers are derived newly each year or upkeep cycle. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA four.0 license)

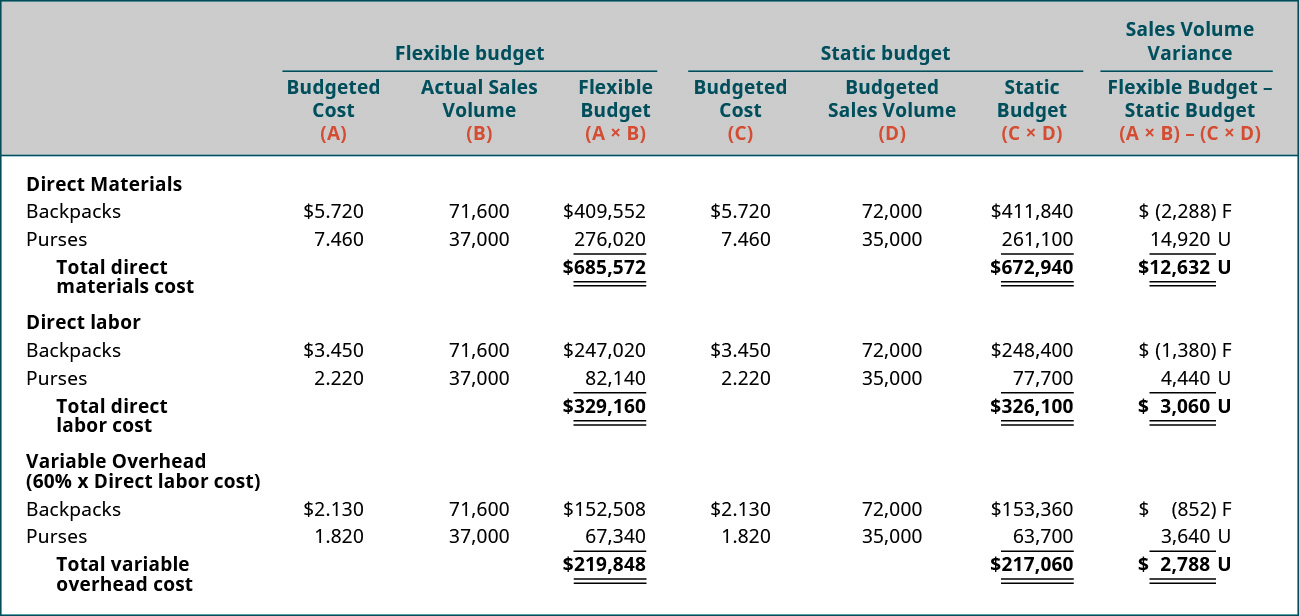

Frequently budgets are adult and then they tin can adjust for changes in the volume or activity and help management make decisions. Changes and challenges tin can affect the budget and have an impact on a company'southward plans. A flexible budget adjusts the cost of goods produced for varying levels of product and is more useful than a static budget, which remains at one amount regardless of the production level. A flexible budget is created at the finish of the accounting menstruation, whereas the static budget is created before the fiscal year begins.

Additionally (Effigy) shows a comparison of a static budget and a flexible upkeep for Bingo'southward Bags, a company that produces purses and backpacks. In the flexible budget, the budgeted costs are calculated with actual sales, whereas in the static budget, budgeted costs are calculated with budgeted sales. The flexible budget allows management to encounter what they would expect the budget to look like based on the actual sales and budgeted costs. Flexible budgets are addressed in greater detail in Prepare Flexible Budgets.

Comparison of a Flexible Budget and a Static Upkeep. (attribution: Copyright Rice University, OpenStax, nether CC BY-NC-SA four.0 license)

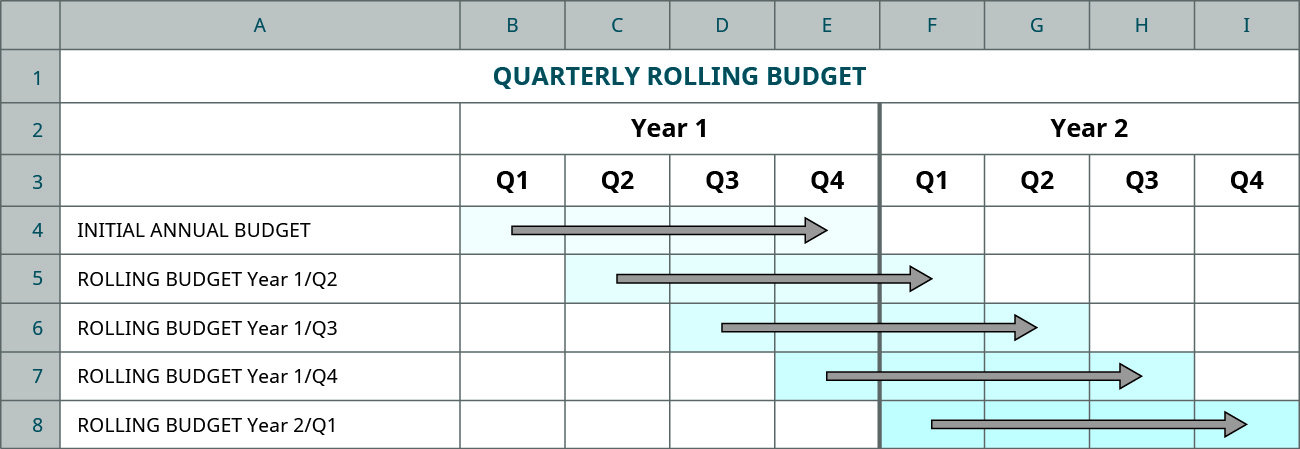

In guild to handle changes that occur in the future, companies tin can too utilize a rolling upkeep, which is one that is continuously updated. While the company's goals may exist multi-year, the rolling budget is adjusted monthly, and a new month is added every bit each month passes. Rolling budgets allow management to respond to changes in estimates or actual occurrences, but it also takes direction away from other duties as it requires continual updating. (Figure) shows an example of how a rolling quarterly budget would work. Notice that as one month rolls off (is completed) another month is added to the budget and then that four quarters of a year are always presented.

Rolling Upkeep. In a quarterly operating budget, the upkeep e'er projects forward for 4 months, or 1 quarter. (attribution: Copyright Rice Academy, OpenStax, nether CC BY-NC-SA iv.0 license)

Because budgets are used to evaluate a manager's operation as well equally the company'southward, managers are responsible for specific expenses within their own budget. Each manager'due south performance is evaluated past how well he or she manages the revenues and expenses under his or her control. Each individual who exercises control over spending should have a budget specifying limits on that spending.

The Role of the Master Budget

Nigh organizations will create a master budget—whether that organisation is big or small, public or private, or a merchandising, manufacturing, or service company. A chief budget is one that includes two areas, operational and fiscal, each of which has its ain sub-budgets. The operating budget spans several areas that help plan and manage day-to-day business concern. The financial budget depicts the expectations for cash inflows and outflows, including cash payments for planned operations, the buy or sale of assets, the payment or financing of loans, and changes in equity. Each of the sub-budgets is made up of carve up simply interrelated budgets, and the number and blazon of separate budgets volition differ depending on the blazon and size of the organization. For example, the sales budget predicts the sales expected for each quarter. The direct materials budget uses information from the sales upkeep to compute the number of units necessary for production. This information is used in other budgets, such as the direct materials budget, which plans when materials will be purchased, how much will exist purchased, and how much that material should cost. Y'all will review some specific examples of budgeting for direct materials in Prepare Operating Budgets.

(Figure) shows how operating budgets and financial budgets are related inside a master budget.

Operating Budgets, Financial Budgets, and the Relationship between Budgets. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

The Role of Operating Budgets

An operating budget consists of the sales upkeep, production budget, straight material budget, direct labor budget, and overhead budget. These budgets serve to aid in planning and monitoring the day-to-day activities of the organization by informing direction of how many units need to be produced, how much material needs to exist ordered, how many labor hours need to be scheduled, and the amount of overhead expected to be incurred. The individual pieces of the operating budget collectively lead to the creation of the budgeted income statement. For example, Large Bad Bikes estimates it will sell 1,000 trainers for $70 each in the first quarter and prepares a sales upkeep to prove the sales past quarter. Management understands that it needs to have on mitt the ane,000 trainers that it estimates will be sold. It likewise understands that additional inventory needs to be on hand in the effect there are boosted sales and to prepare for sales in the 2nd quarter. This information is used to develop a product upkeep. Each trainer requires 3.2 pounds of fabric that usually costs $1.25 per pound. Knowing how many units are to be produced and how much inventory needs to be on hand is used to develop a straight materials budget.

The direct materials upkeep lets managers know when and how much raw materials need to be ordered. The same is truthful for straight labor, every bit direction knows how many units will be manufactured and how many hours of direct labor are needed. The necessary hours of direct labor and the estimated labor rate are used to develop the direct labor budget. While the materials and labor are determined from the production upkeep, just the variable overhead can be adamant from the production budget. Existing information regarding fixed manufacturing costs are combined with variable manufacturing costs to determine the manufacturing overhead budget. The information from the sales budget is used to determine the sales and administrative budget. Finally, the sales, direct materials, straight labor, fixed manufacturing overhead upkeep, and sales and authoritative budgets are used to develop a pro-forma income statement.

The Role of Financial Budgets

A fiscal budget consists of the greenbacks budget, the budgeted balance sheet, and the upkeep for capital expenses. Similar to the private budgets that make upwards the operating budgets, the financial budgets serve to assistance with planning and monitoring the financing requirements of the organization. Management plans its capital asset needs and states them in the capital expense budget. Direction addresses its collection and payment policies to determine when it volition receive cash from sales and when it will pay the material, labor, and overhead expenses. The uppercase expense budget and the estimated payment and collection of greenbacks permit management to build a cash upkeep and determine when it will need financing or accept additional funds to pay back loans. These budgets taken together will be part of the approaching balance canvas. (Effigy) shows how these budgets chronicle.

Maintaining a Cash Balance

DaQuan recently began work as a senior accountant at Mad Coffee Company. He learned he would be responsible for monitoring the greenbacks balance because in that location is a banking concern loan requirement that a minimum balance of $10,000 exist maintained with the banking company at all times. DaQuan asked to see the cash budget and so he could anticipate when the balance was nearly probable to go below $10,000. How tin can DaQuan determine potential cash balance issues by looking at the upkeep?

Solution

Budgeting helps plan for those times when cash is in short supply and bills need to be paid. Proper budgeting shows when and for how long a cash shortage may be. DaQuan can see the months when the greenbacks payments exceed the greenbacks receipts and when the visitor is in danger of having a cash residual below the minimum requirement of $x,000. Knowing the inflow and outflow of cash will help him plan and manage the shortage through a line of credit, delay in purchasing, delay in hiring, or delay in payment of not-essential items.

Budgeting is a task that should exist completed by all organizations, not simply those limited to manufacturing. Unfortunately, there are many individuals who desire to operate a business and know nothing about budgeting. Frequently, professional organizations or industry trade groups offer information to help their members succeed in concern. For example, the real manor profession provides information and suggestions such as this article on preparing a marketing budget to help professionals.

Cardinal Concepts and Summary

- A proficient budgeting system assists direction in reaching their goals through the planning and control of cash inflows through revenue and financing and outflows through payment and expenses.

- There are various budgeting strategies including bottom-up, elevation-down, and zero-based budgeting.

- A static upkeep is prepared at one level of activeness, while a flexible budget allows the variable expenses to be adjusted for various levels of activeness.

- A principal budget includes the subcategories of operating budgets and fiscal budgets.

- A principal upkeep is developed at the estimated level of activity.

(Effigy)Which of the post-obit is not a part of budgeting?

- planning

- finding bottlenecks

- providing functioning evaluations

- preventing net operating losses

(Figure)Which of the following is an operating upkeep?

- greenbacks budget

- production budget

- tax budget

- majuscule budget

(Figure)Which of the following is a finance budget?

- cash budget

- production upkeep

- directly materials purchasing budget

- tax upkeep

(Effigy)Which approach is most likely to event in employee buy-in to the budget?

- top-downward approach

- bottom-upwards arroyo

- full participation arroyo

- basing the budget on the prior year

(Figure)Which arroyo requires management to justify all its expenditures?

- bottom-up approach

- nix-based budgeting

- master budgeting

- capital allotment budgeting

(Figure)Which of the following is true in a bottom-up budgeting approach?

- Every expense needs to be justified.

- Supervisors tell departments their upkeep corporeality and the departments are free to work within those amounts.

- Departments budget their needs still they see fit.

- Departments determine their needs and relate them to the overall goals.

(Figure)The most common budget is prepared for a ________.

- week

- calendar month

- quarter

- year

(Figure)What is a upkeep and what are the different types of budgets?

A upkeep is a written fiscal plan for a prepare catamenia, which is typically a year. There are several different types of budgets including the master budget, operating budget, financial budget, flexible budget, and operating upkeep.

(Figure)What is the deviation betwixt budgeting and long-range planning?

(Figure)What are the advantages and disadvantages of the lesser-upwards budgeting approach?

This approach begins at the everyman levels of management. These managers know the details involved with their departments. This allows for more accurate budget estimates when management understands how their department contributes to the company's goals. Disadvantages include that this type of budgeting takes fourth dimension, which leads to more labor costs, and when management doesn't fully understand how it contributes to the company goals, the budget may back up the department and not the visitor.

(Figure)Why might a rolling budget require more management participation than an annual budget?

(Figure)Why is a articulate understanding of management's goals and objectives necessary for effective budgets?

(Figure)It is proper budgeting procedure to brainstorm with estimated revenues, but why might some nonprofit entities brainstorm planning their expenditures instead of their revenues?

Glossary

- budget

- quantitative program estimating when and how much cash or other resources volition be received and how the cash or other resources volition be used

- financial upkeep

- category of budgeting that details estimates for greenbacks inflows and outflows through planned operations and changes majuscule investments of assets, liabilities, and equities

- main budget

- overall budget that includes the operating and financial budgets

- operating budget

- category of budgeting that helps managers plan and manage production, social club materials, schedule direct labor, and monitor overhead expenses

- rolling budget

- budget that is continuously updated by adding an additional upkeep menstruum at the end of the current budget period

- zero-based budgeting

- upkeep that begins with goose egg dollars and then includes in the budget only acquirement and expenses that can be supported or justified

Source: https://opentextbc.ca/principlesofaccountingv2openstax/chapter/describe-how-and-why-managers-use-budgets/

0 Response to "One Difficulty With Self-imposed Budgets Is That They Are Not Subject to Any Type of Review"

Post a Comment